Introduction In today’s unpredictable financial markets, secure and consistent investments are harder to come by—unless you’re exploring Private Placement Programs (PPPs). With Wealthy Credit Limited, you gain access to high-level, secure PPP opportunities that offer strong returns with minimal exposure. Let’s explore how our trusted platform works and how you can become part of it. […]

Business owners might find themselves in a situation where they need a capital infusion — and fast. That generally takes traditional lending institutions off the table. Banks and credit unions offer business loans, but they come with lengthy and rigorous application processes, which can take days or weeks to get funding.

Are you looking for the quickest and easiest way to BMO harris express loan pay? If so, you have come to the right place! This blog post will provide you with the information you need to quickly and easily pay off your BMO harris express loan. We will discuss the various payment methods available, how […]

Commercial loan truerate services are a helpful resource that may assist you in obtaining the funding you require to launch your firm. By working with a professional truerate company, you can get the accurate information needed to ensure your loan is in good shape and will be repaid promptly. Commercial loan truerate services are a […]

Monetization of financial instruments refers to the process by which you can turn assets or liabilities into cash or other forms of exchange. You may do this via a variety of strategies, including borrowing money, selling stocks, and purchasing assets. Some standard monetization methods include call-and-put options, futures contracts, and venture capital investments. Are you […]

Getting a Bitcoin backed Loan online is fairly easy – just as services booked over the Internet should be these days. 1. Register with a Loan Provider A Bitcoin Loan Provider is a company that provides financial services related to the normal Fiat Money System. Therefore such companies are obliged to follow a KYC policy […]

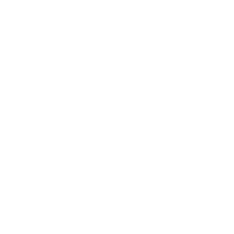

Since your startup days, you’ve grown big and strong Expansion Financing. Now you want to invest to grow even bigger. Here are the primary sources you can look to. You can’t grow unless you have money to invest in growth. That may seem strange at first. After all, growth is supposed to generate additional sales […]

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion. Investors invited to participate in private placement programs include wealthy individual investors, banks and […]

Many entrepreneurs looking to start a business get confused about the best funding sources to seek for their startup. With the many options, there are, choosing the ideal source of financing can be an overwhelming process; however, weighing the pros and cons of each source will help you choose the ideal one to go ahead […]

Overview Recourse and non recourse loan allow lenders to lay claim to assets if borrowers default on their obligations and fail to repay their debts. Lenders are allowed to take possession of any assets used as collateral to secure these loans. Many loans are taken out with one or more assets of a certain value […]